First Class Tips About Which Pattern Is Best For Trading How To Change Range Of Graph In Excel

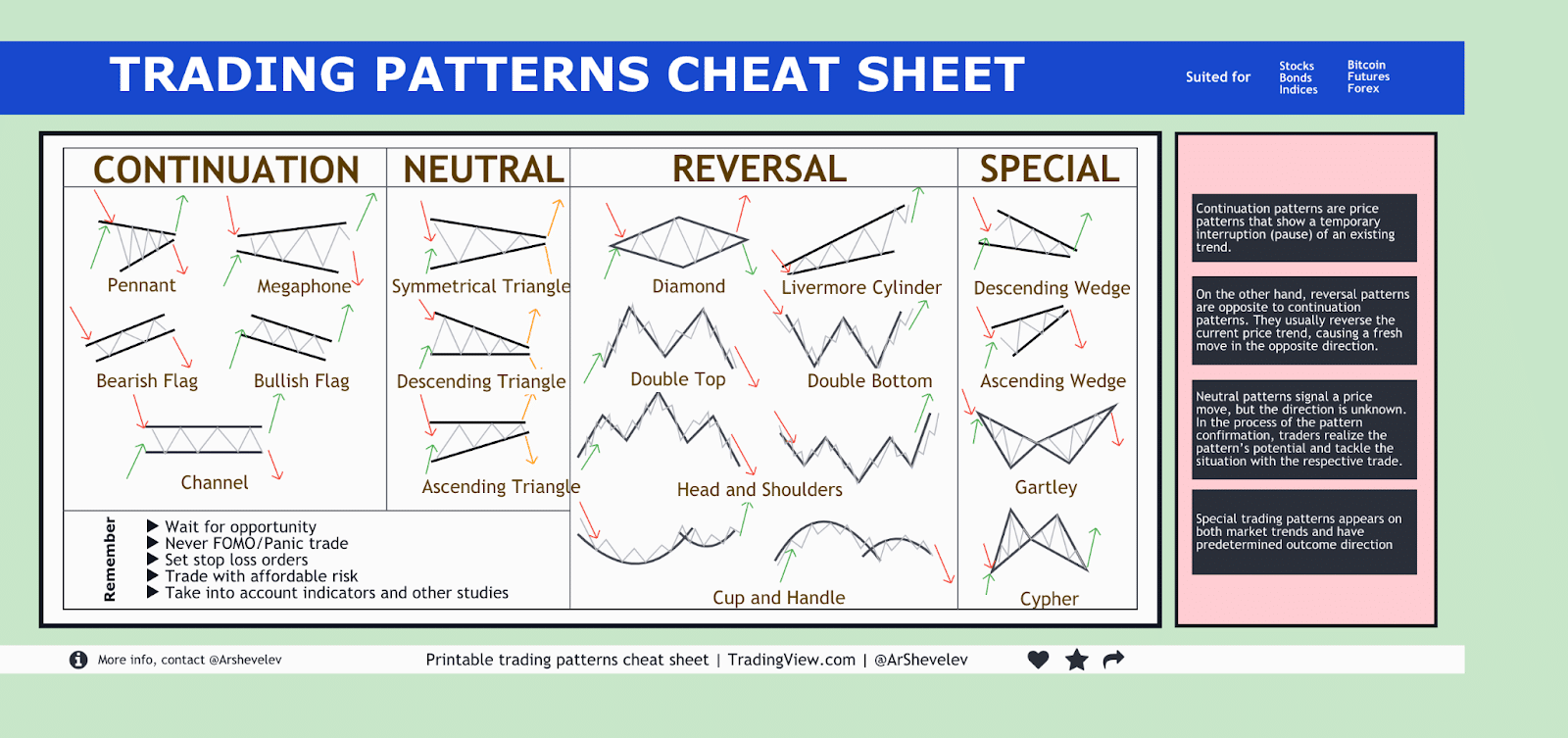

Explore the top 11 trading chart patterns every trader needs to know and learn how to use them to enter and exit trades.

Which pattern is best for trading. In the world of technical analysis there are a lot of traders who talk about price action patterns but few actually discuss. So what are chart patterns? The company is the latest in a string of silicon valley stars to feel the wrath of the ftc over “dark patterns,” website and app features the agency contends.

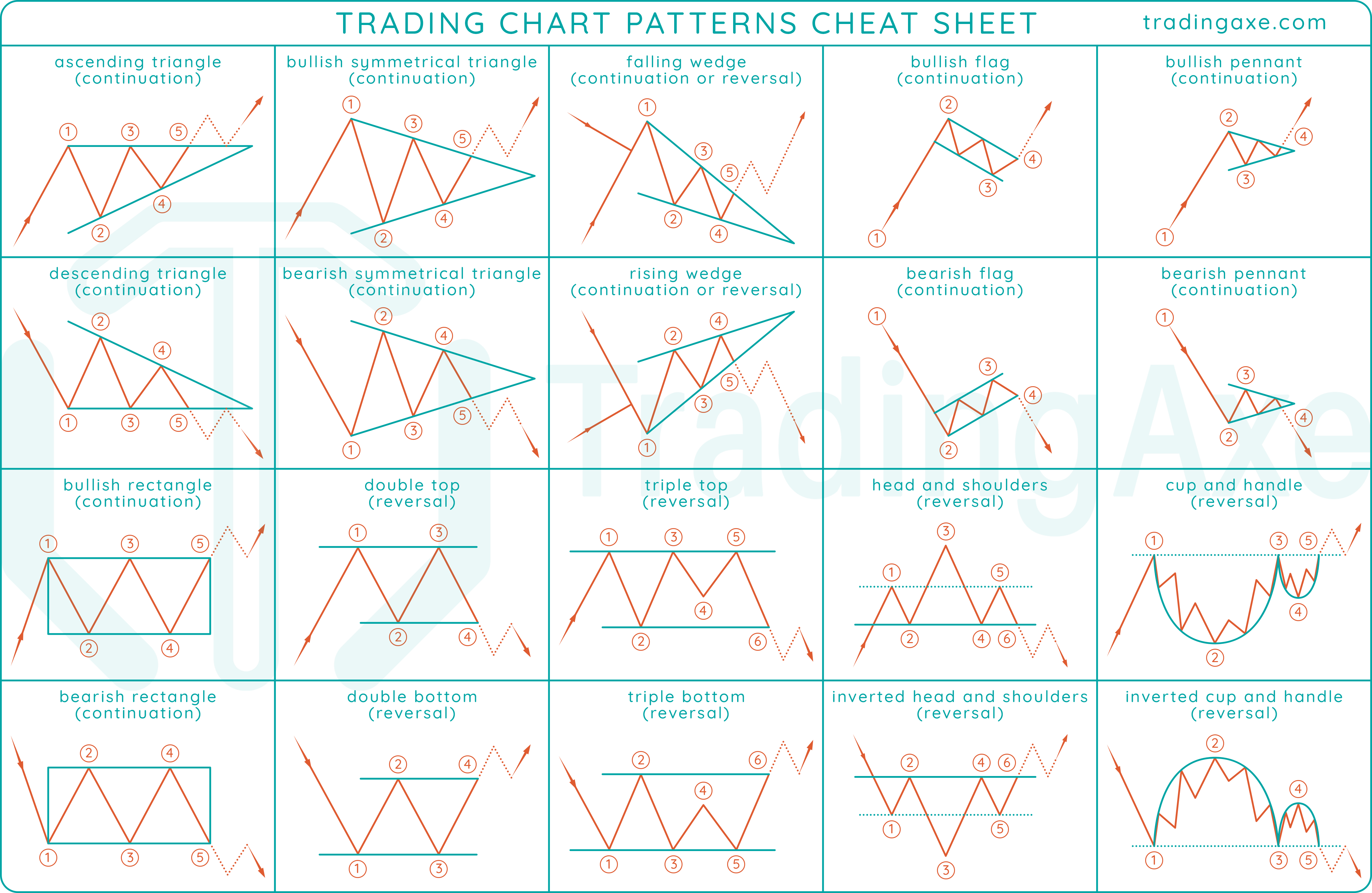

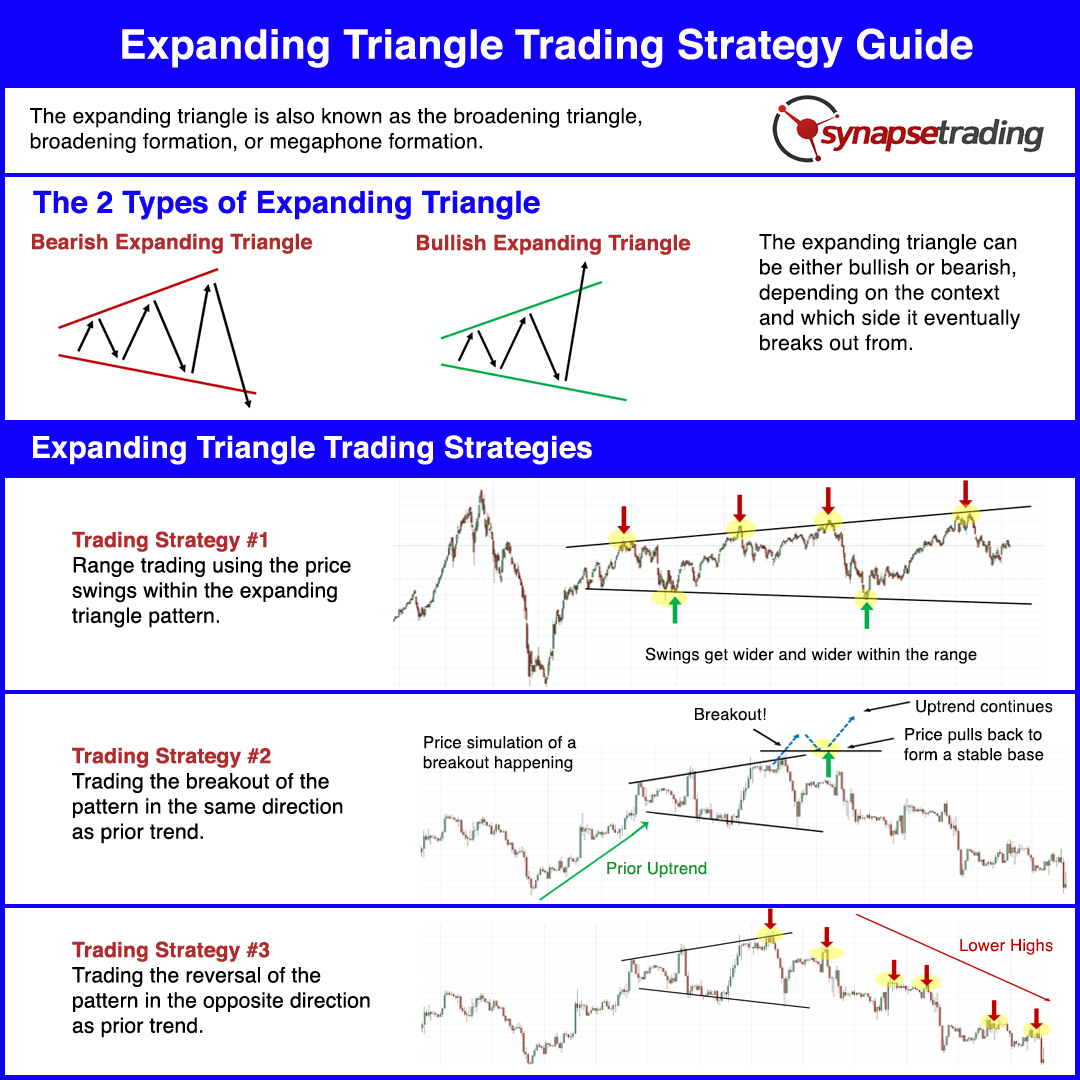

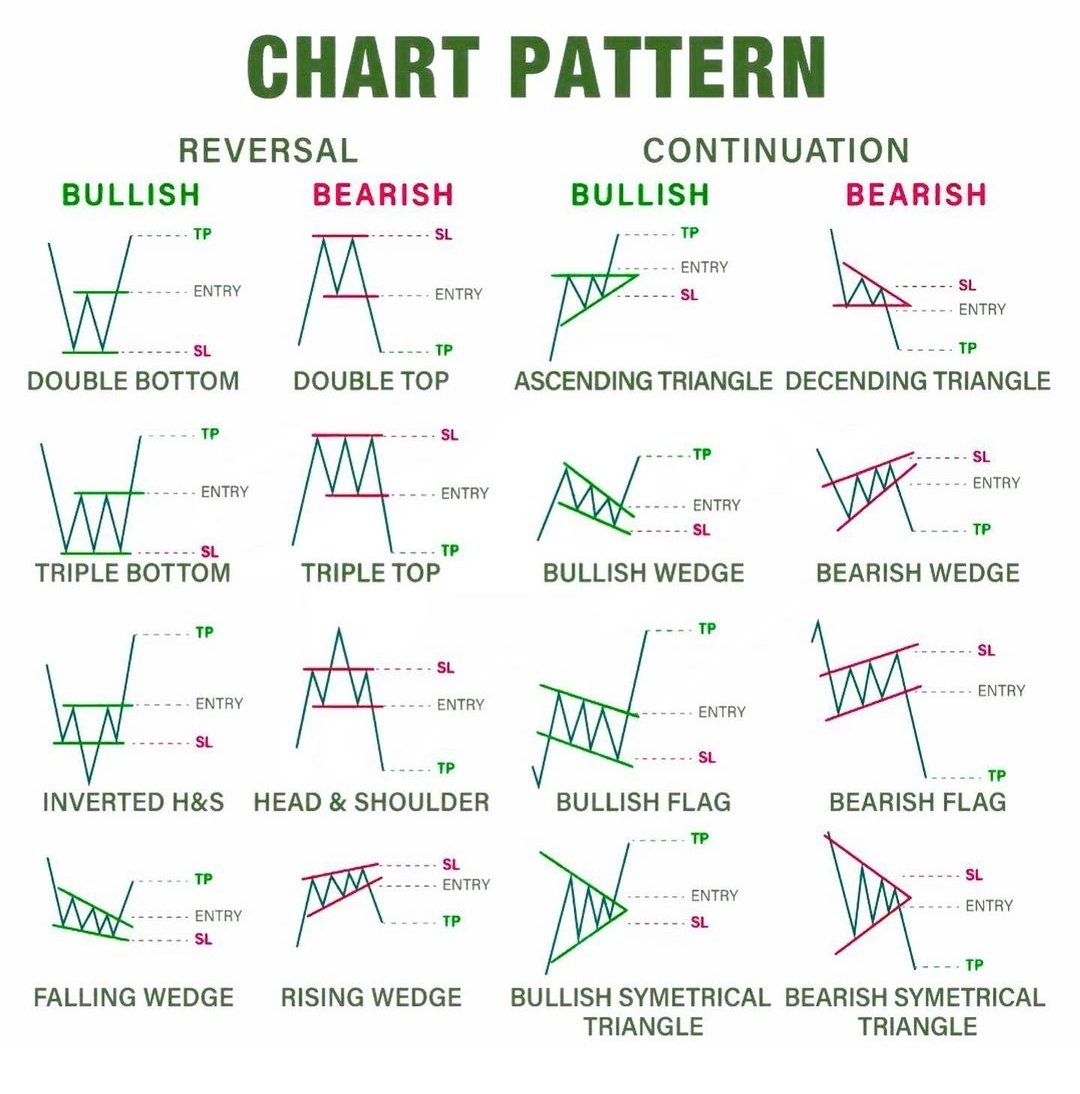

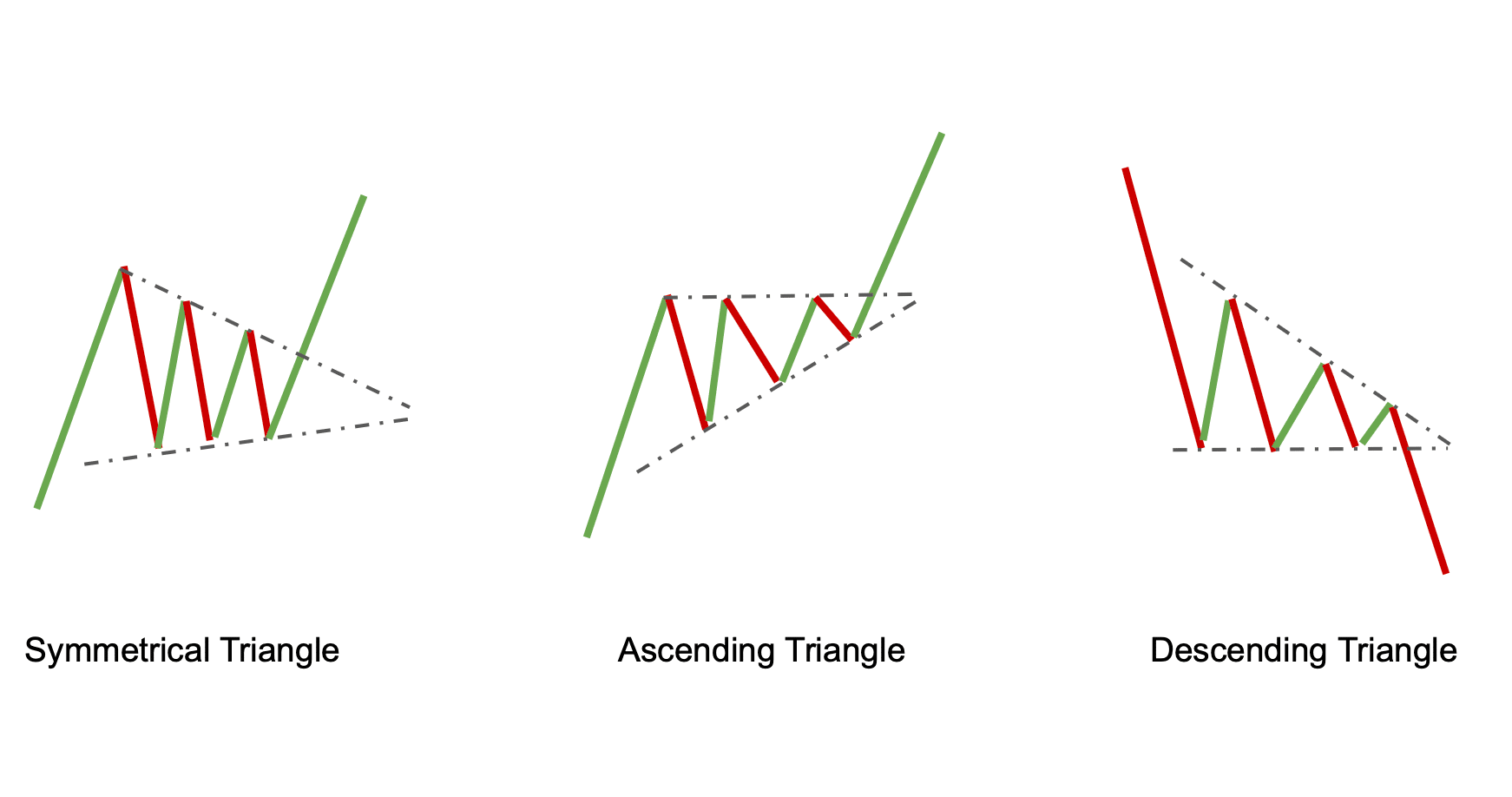

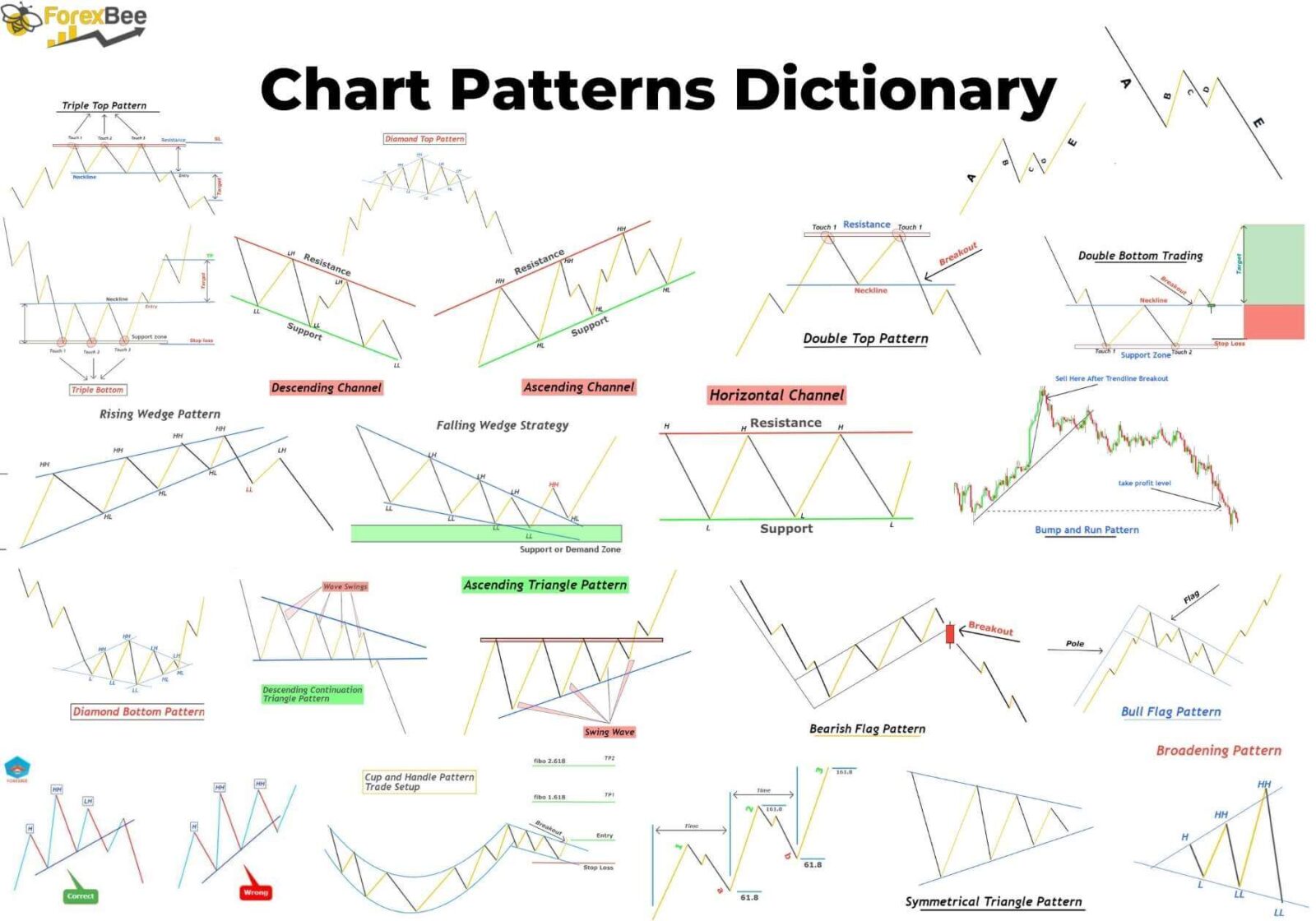

Ascending and descending staircases are probably the most basic chart patterns. While these methods could be complex, there are simple. Chart patterns are the basis of technical.

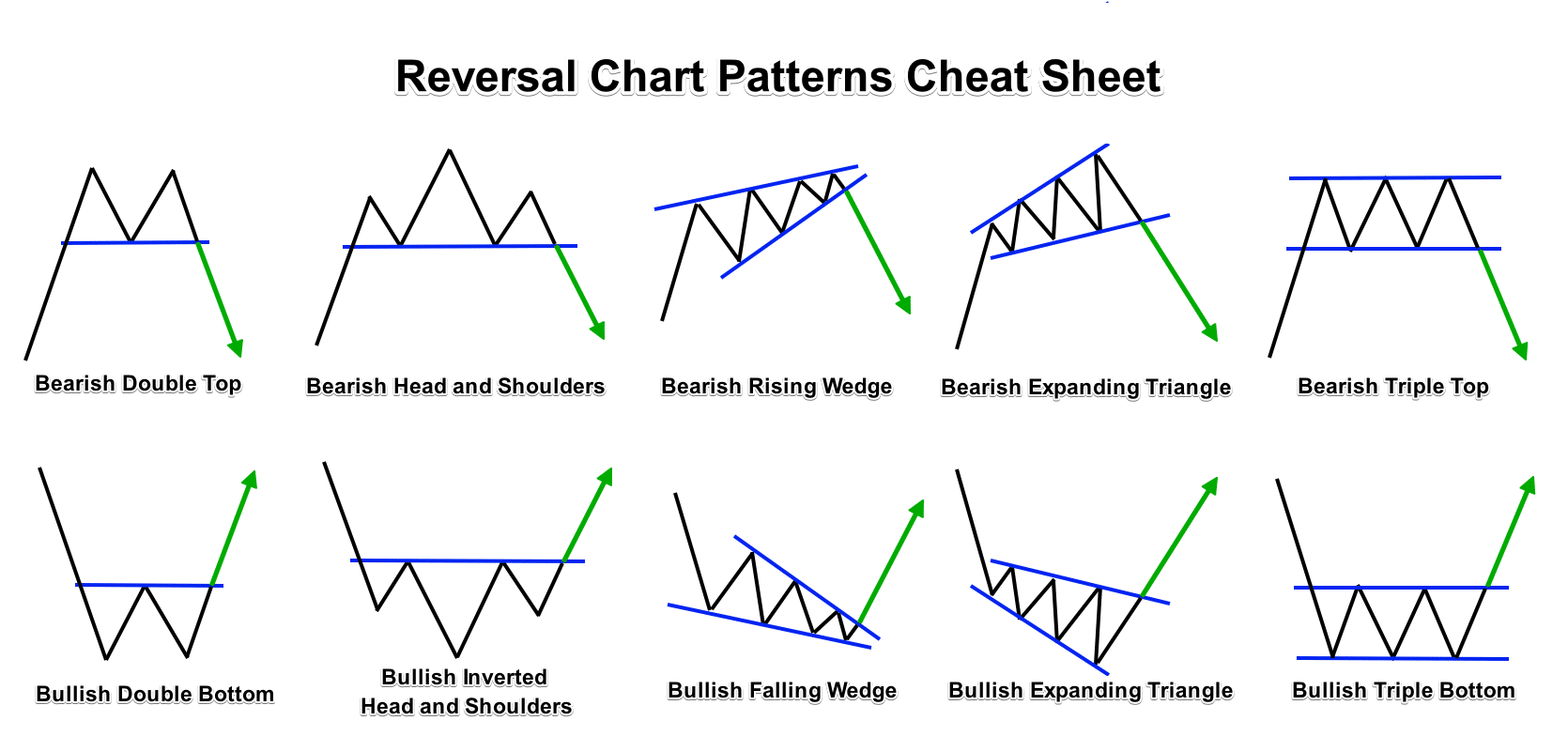

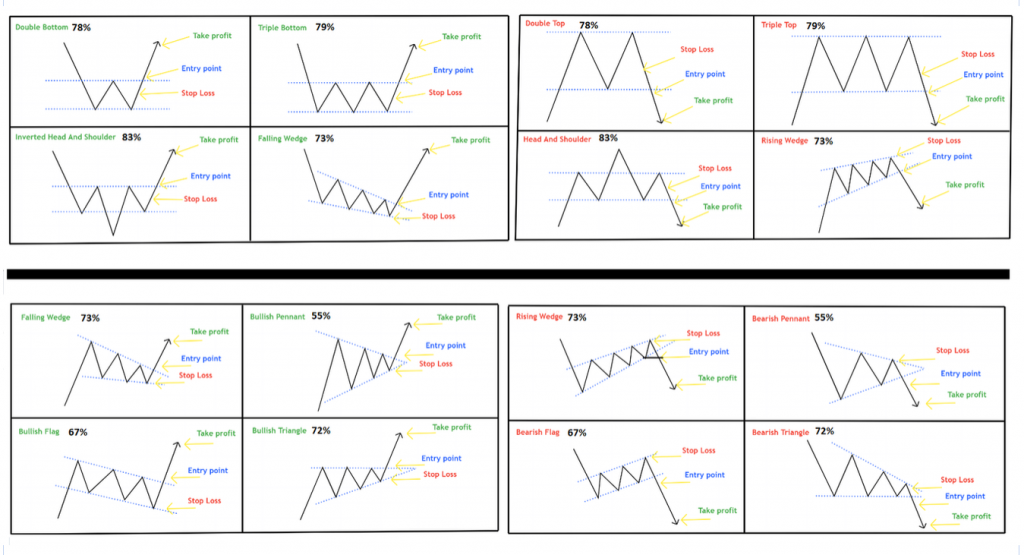

Which pattern is best for trading? This table shows the chart pattern success rate/probability of a price increase in a bull market and the average price increase after emerging from. The treble top forex pattern tests the resistance zone three times.

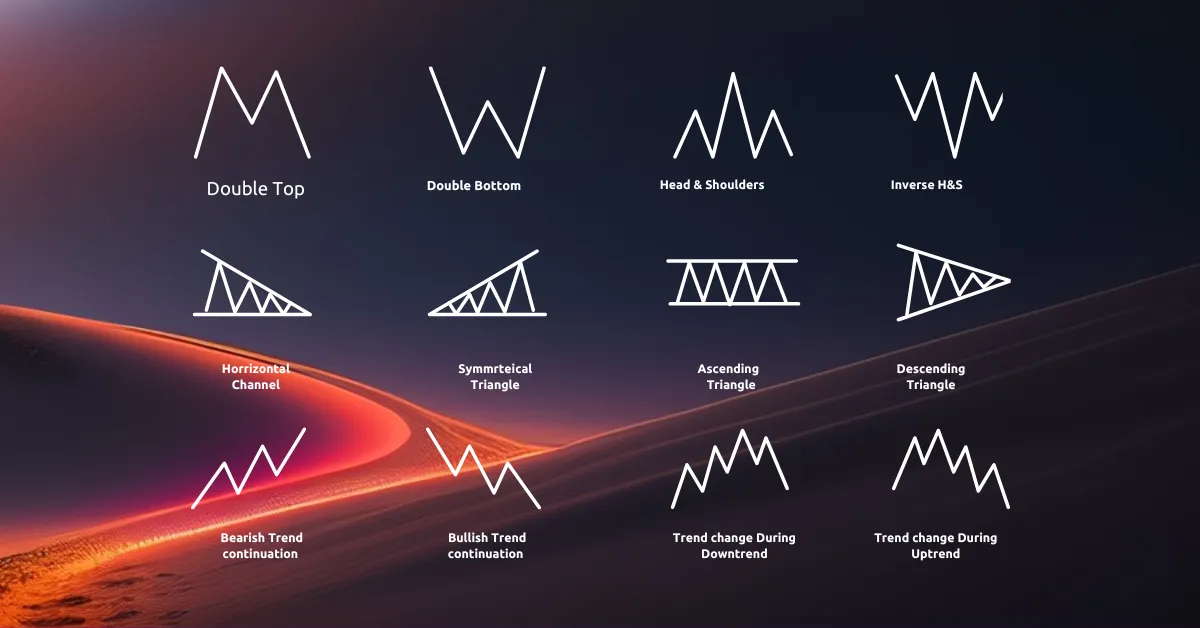

Why it’s essential to analyze the trading chart patterns? A chart pattern is a shape within a price chart that helps to suggest what prices might do next, based on what they have done in the past. Chart patterns are unique formations within a price chart used by technical analysts in stock trading (as well as stock indices,.

Explore the top 11 trading chart patterns every trader needs to know and learn how to use them to enter and exit trades. Snap has a momentum style score of b, and shares are up 9.1% over the past four. The pattern in question is related to the netflows for the wallets associated with the ethereum foundation.

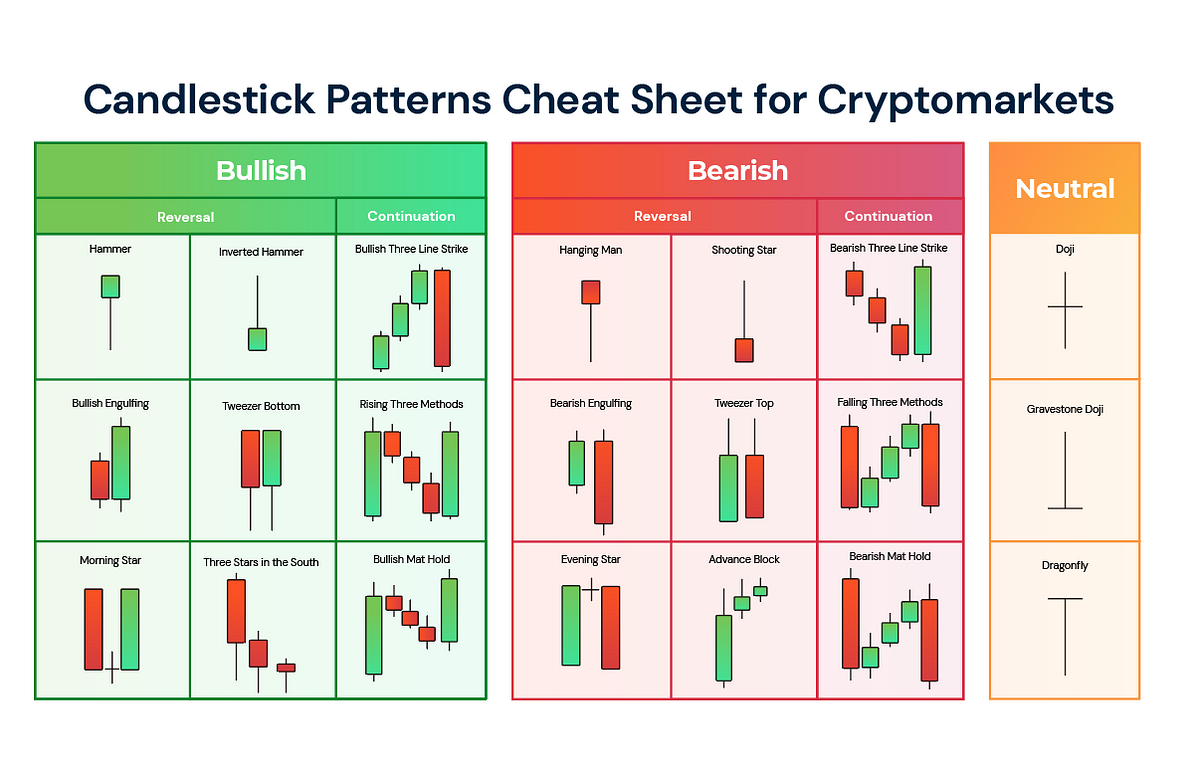

Injective forms bullish patterns on the charts. In this essential guide to the top 10 chart patterns, we. Hammer and hanging man.

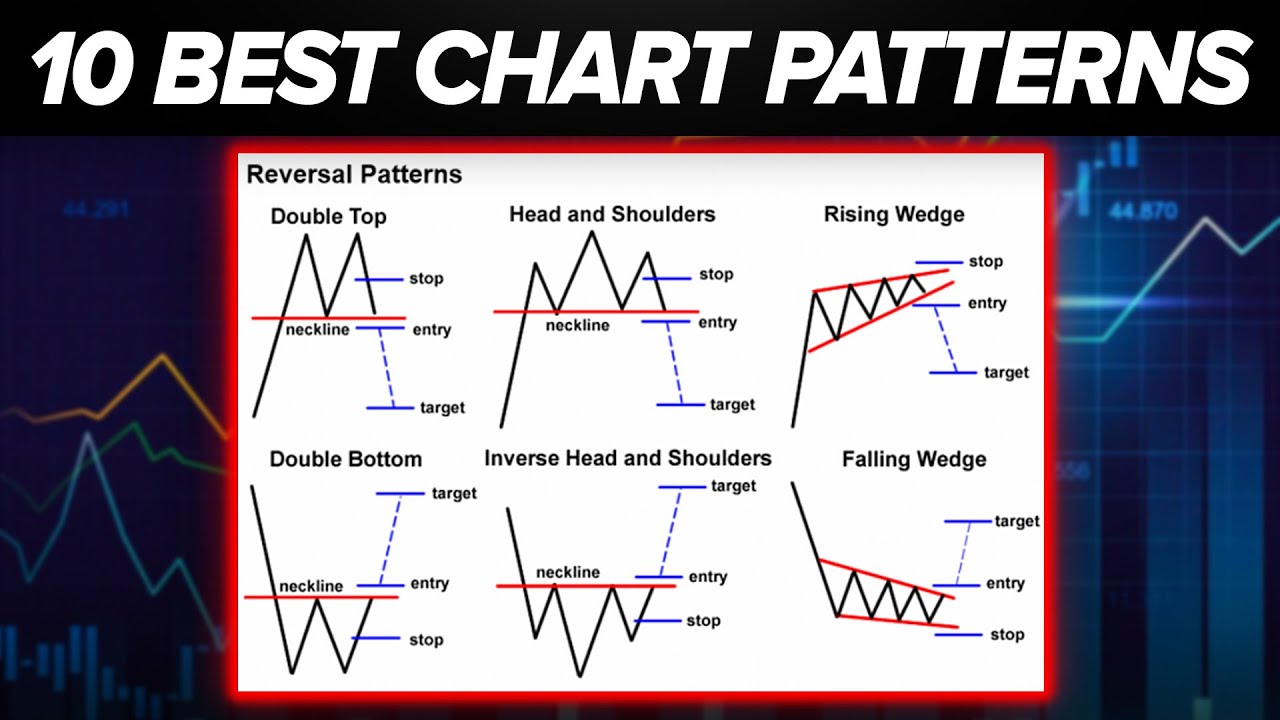

It is sometimes analysed as a head and. Here are the 10 best stock chart patterns. The 7 best price action patterns ranked by reliability.

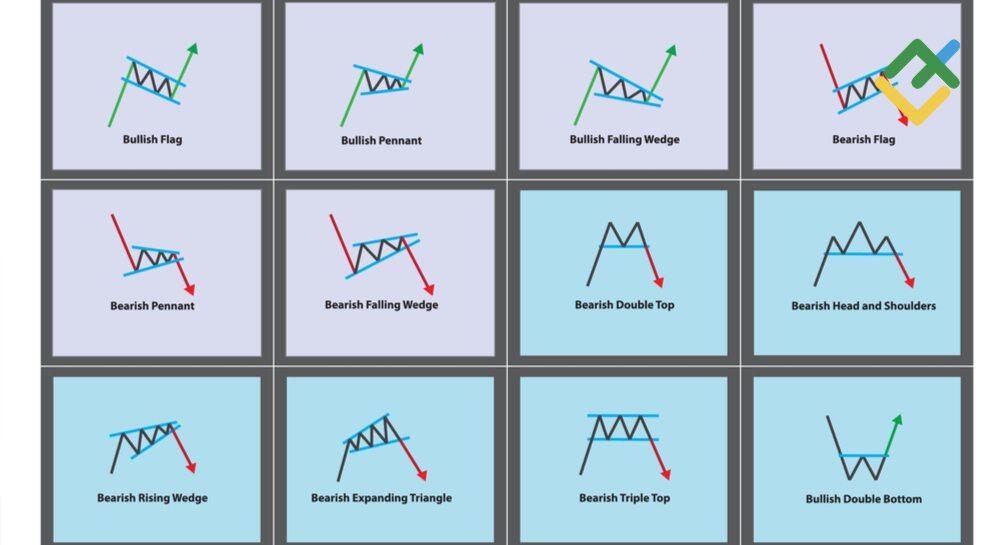

The pattern is named for its resemblance to. Types of trading chart patterns. In today's video, i'm highlighting the 10 best chart patterns that all technical traders should know to tackle the market.chart patterns are one of the most.

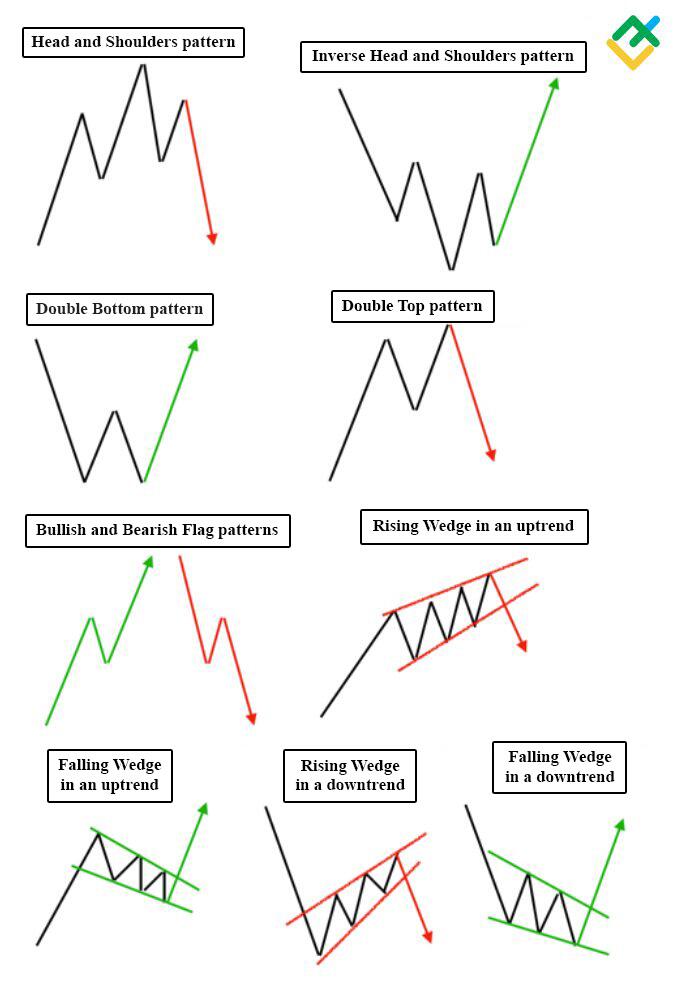

A bullish reversal pattern found at the bottom of a downtrend, characterized by a small body and a long lower shadow. They provide technical traders with. The head and shoulders pattern is a reliable reversal pattern that forms after an uptrend.

Head and shoulders, candlestick and ichimoku forex patterns all provide visual clues on when to trade. What are stock chart patterns? When you analyse trading charts, you’ll see certain.