Sensational Tips About What Is Bullish Trend Line Scatter Plot With Regression Python

Bullish three line strike is a four candle bullish continuation candlestick pattern.

What is bullish trend line. It forms in a bullish trend and is believed to signal the continuation of the bullish. Trend liquidity when a trending forms in the market, bullish or bearish, your focus shouldn’t be on selling. What is bullish and bearish trend?

Here is list of the classic ones: A bull market is a market that is on the rise and where the conditions of the economy are generally favorable. The white line at 0.0000 is the zero line.

Inverted head and shoulders ; A bullish trend is an upward trend in the prices of a trading asset, and a bearish trend is a downtrend. A bear market exists in an economy that is receding.

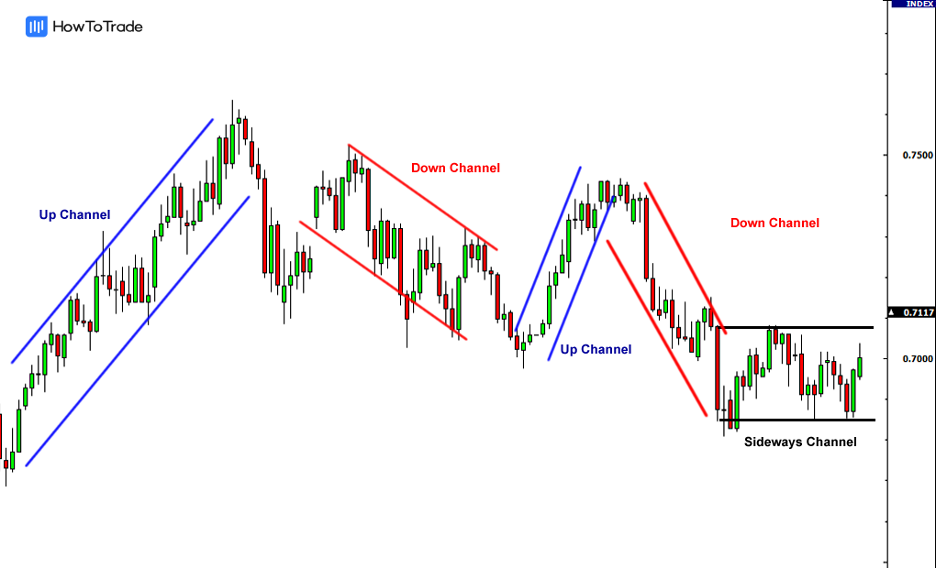

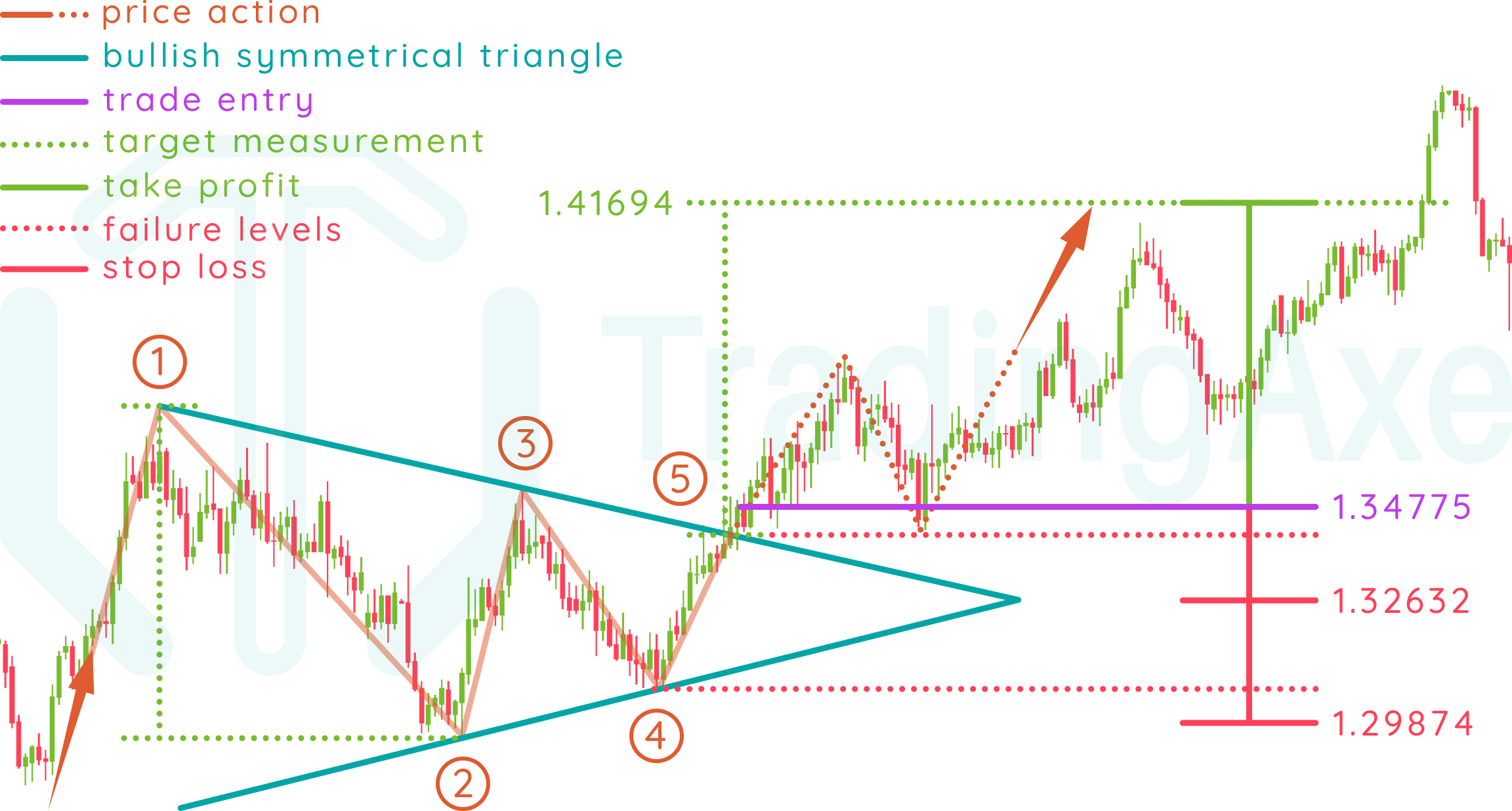

Trend lines, they show where the. If the macd ema is above the zero line, there is a bullish trend. A trend line in forex refers to the analysis of an asset that relies on visually spotting different areas on the chart.

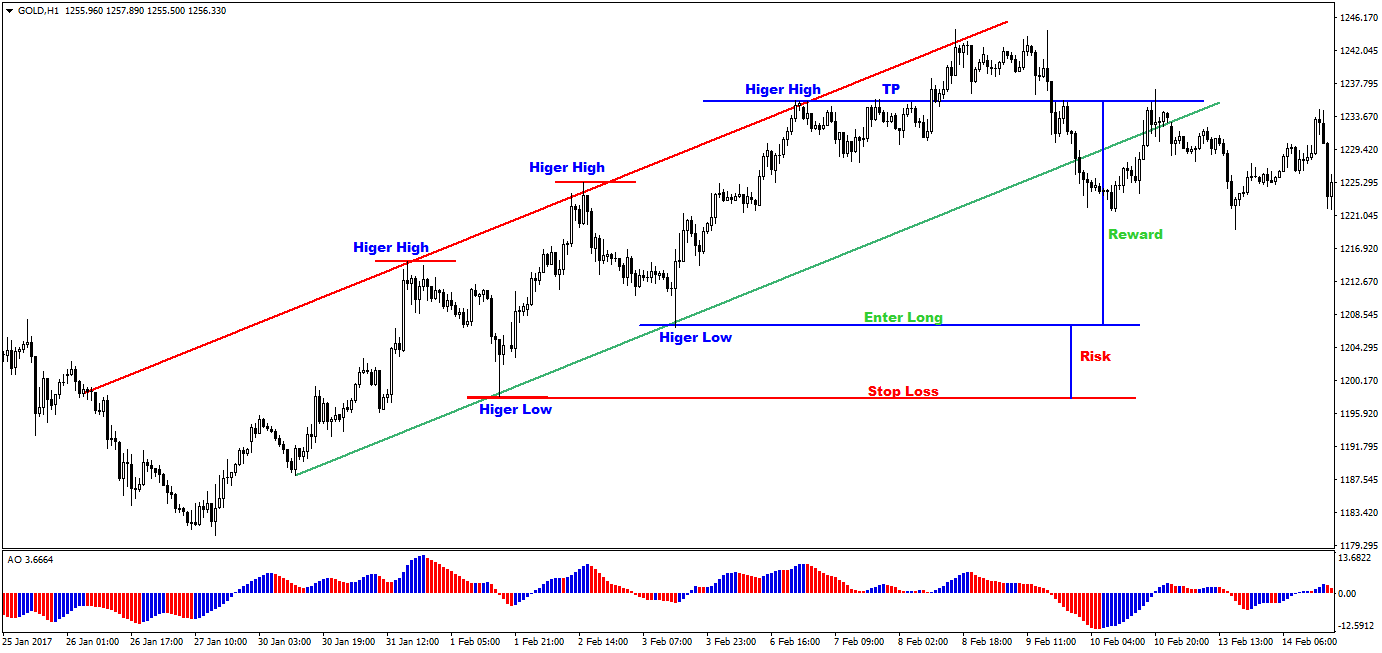

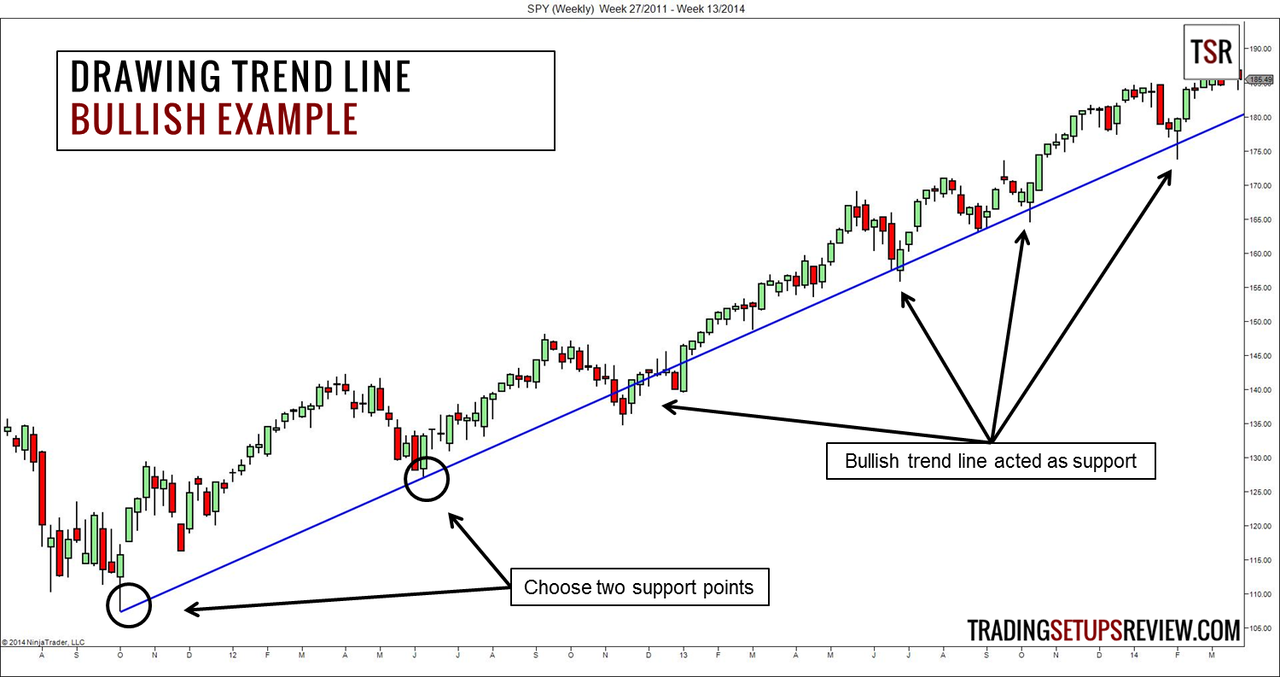

A bullish trendline is a line drawn by connecting a series of rising low price points on a price chart. An uptrend, or bullish trend, means that the price is moving higher. According to experts, longer cycles suggest that the.

Bullish and bearish are two terms commonly used in the financial markets to describe the market sentiment and the predicted price trend of a particular asset such. These lines help traders identify bullish trends in the market. A trend line connects at least 2 price points on a chart and is usually extended forward to identify sloped areas of support and.

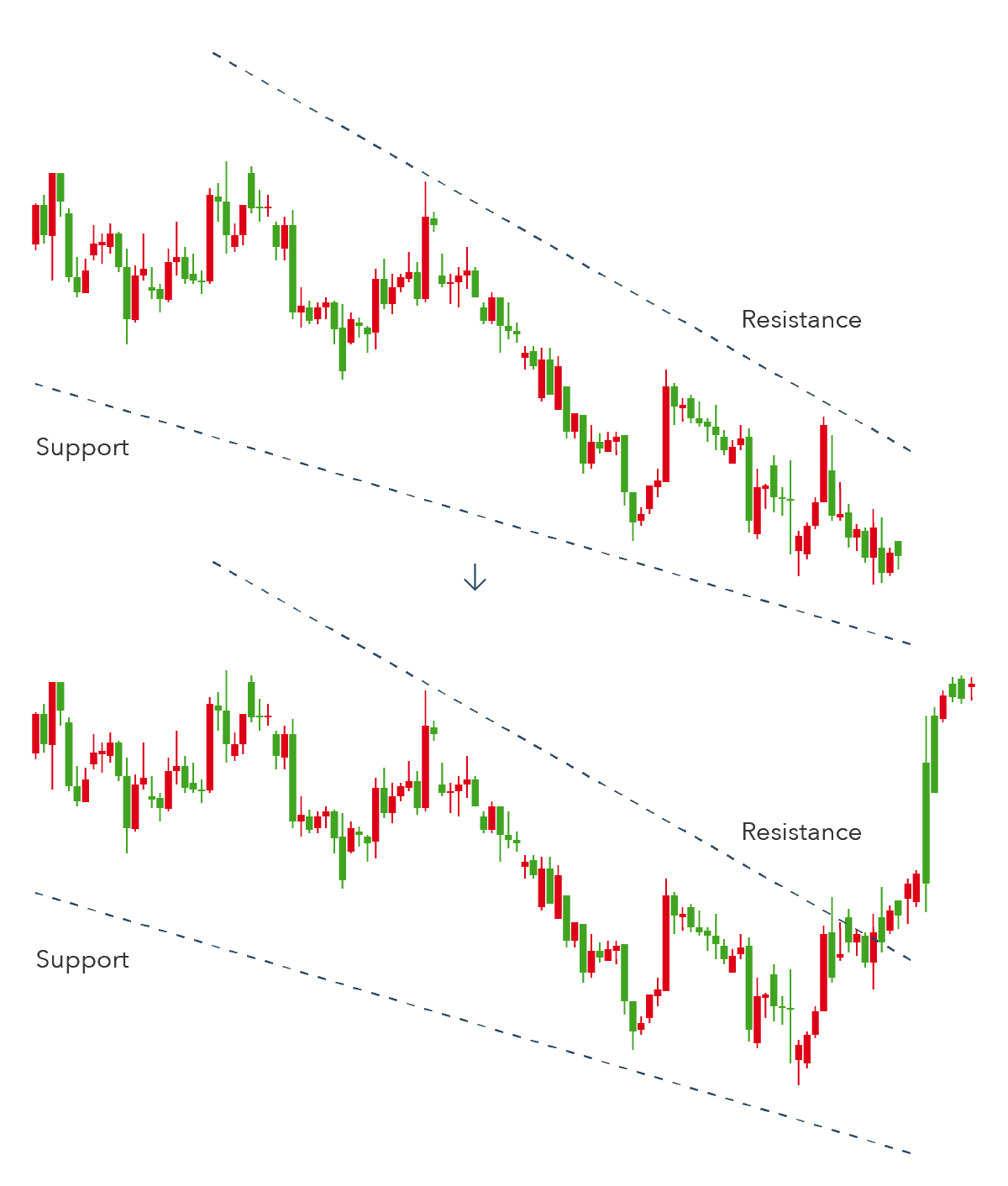

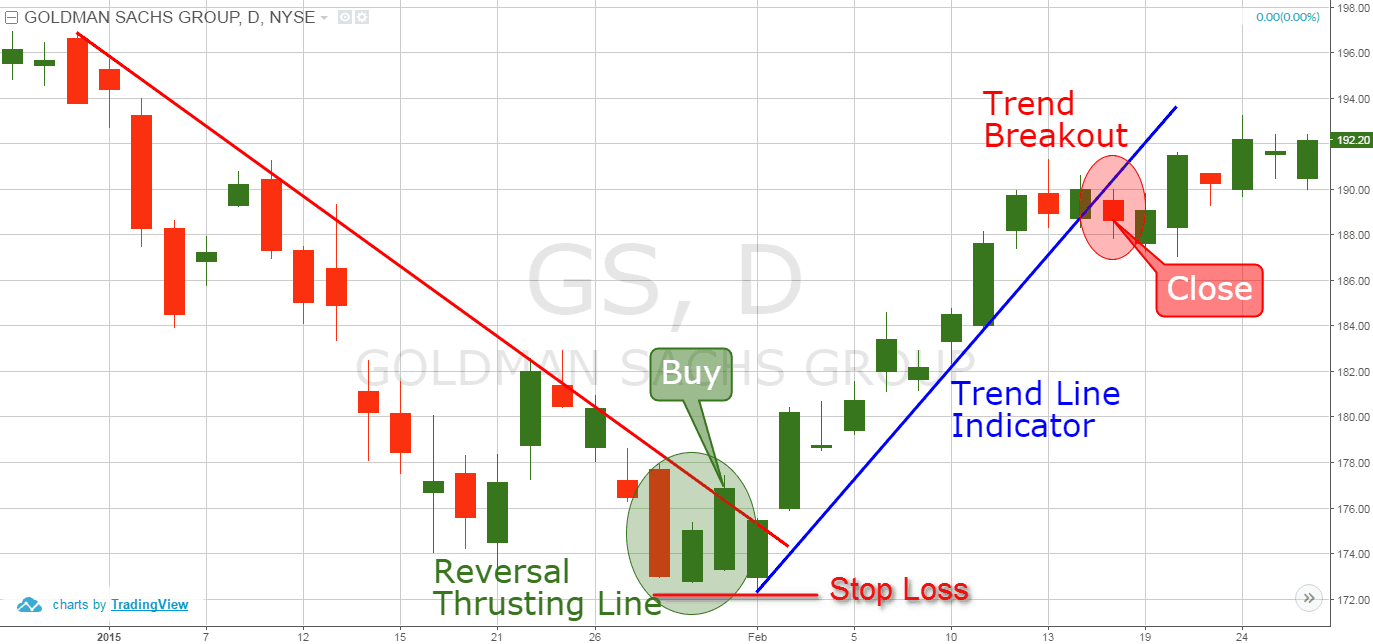

Traders often use technical analysis tools,. Because these lines are drawn at specific angles, they. As the name implies, trend lines are levels used in technical analysis that can be drawn along a trend to represent either support or resistance, depending on the direction of.

A bullish investor, also known as a bull, believes that the price of one or more securities will rise. A bearish investor is one who believes prices will go down and. The basic principle is that each new low is higher than the previous low, indicating that.

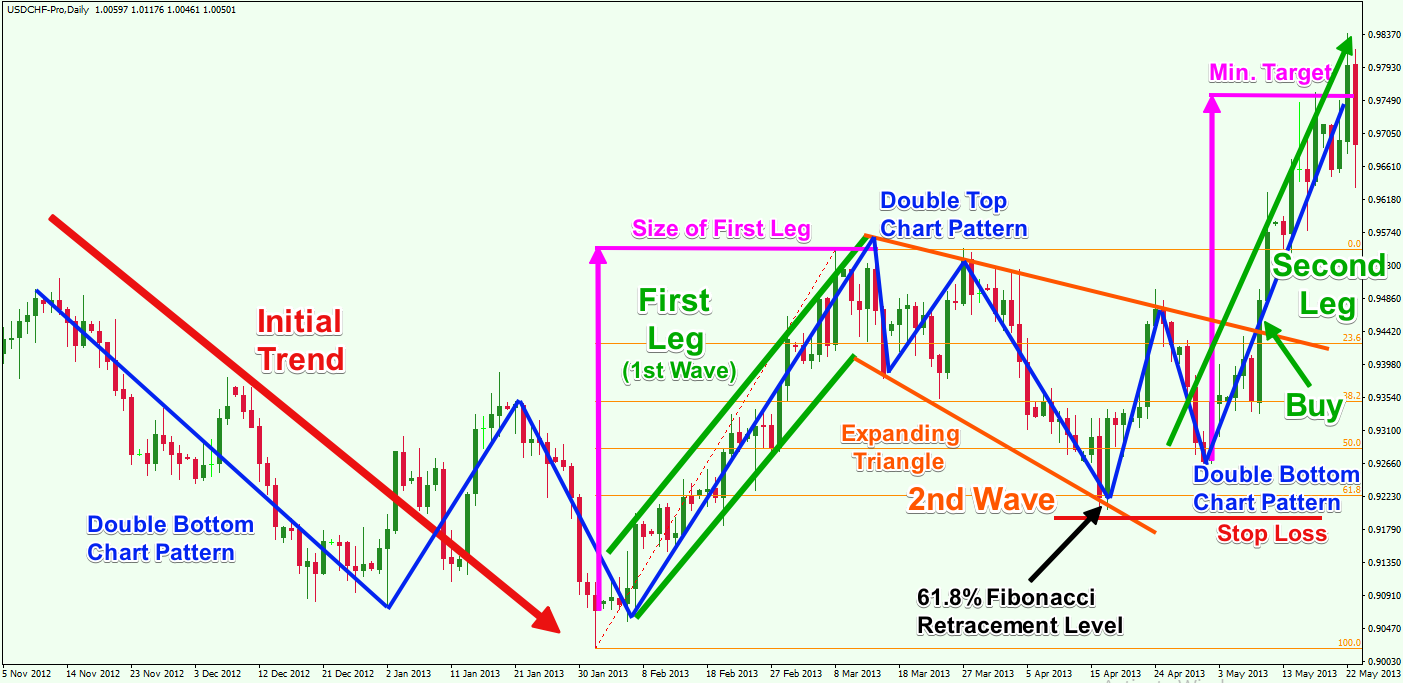

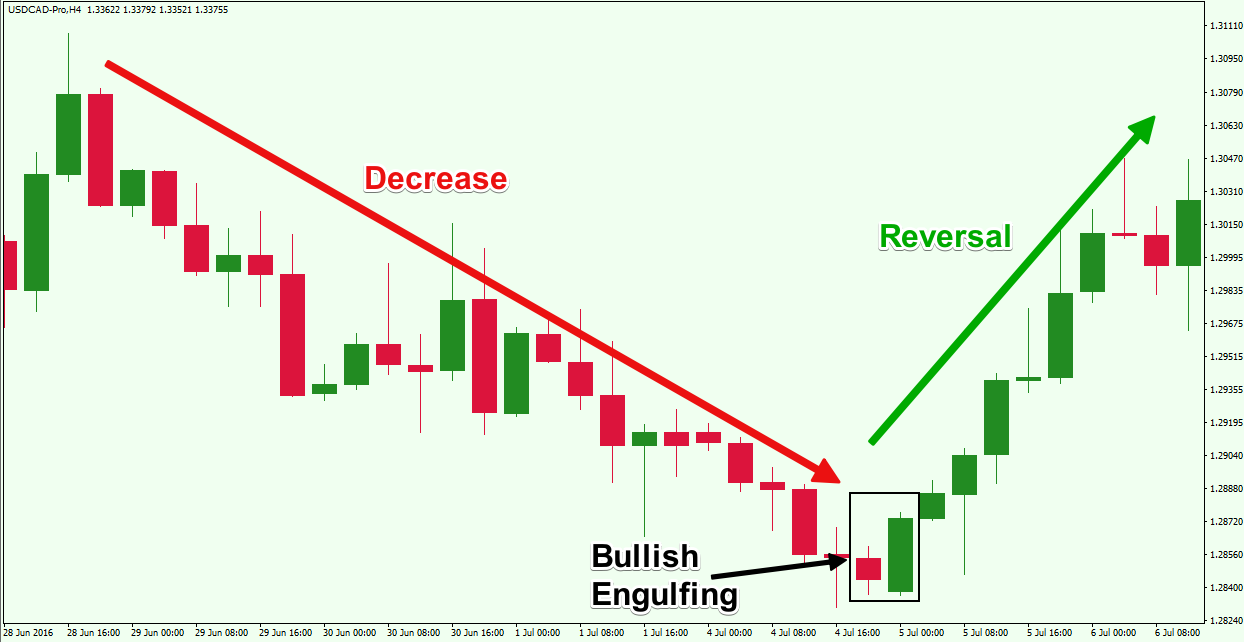

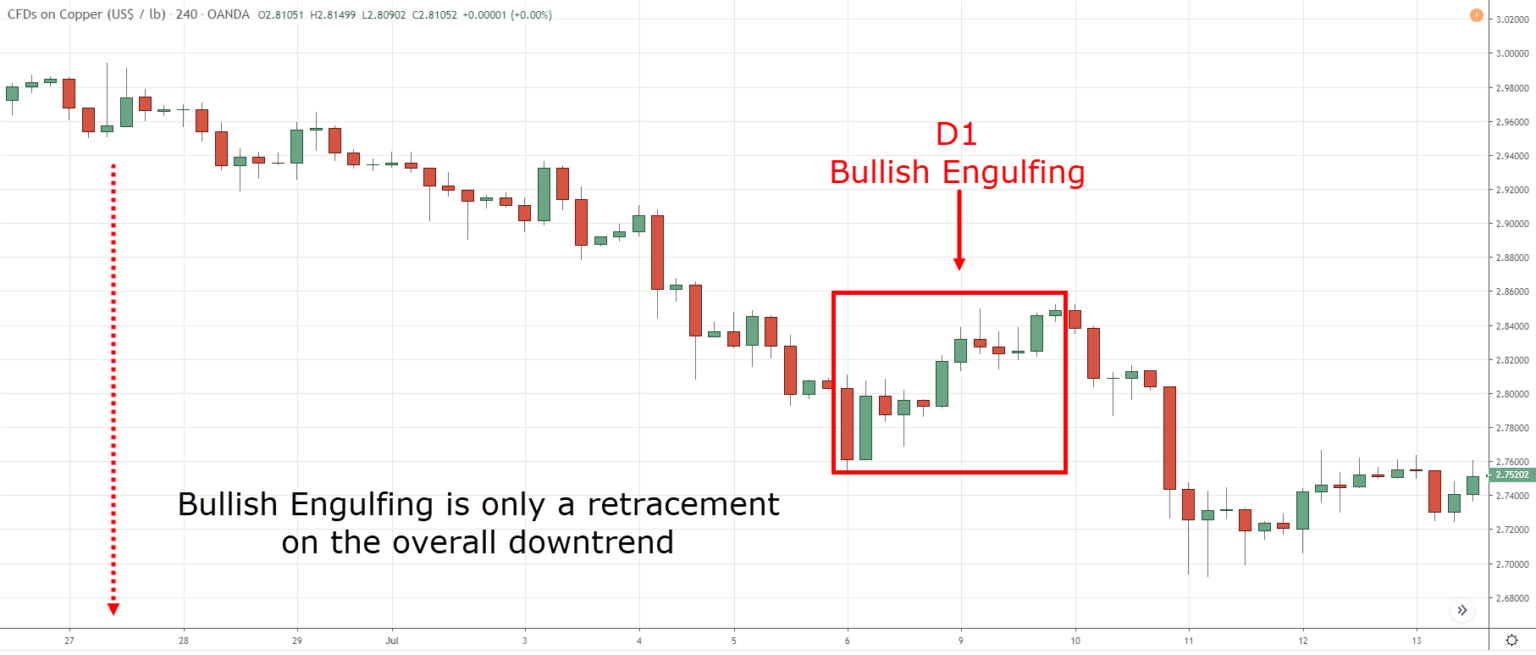

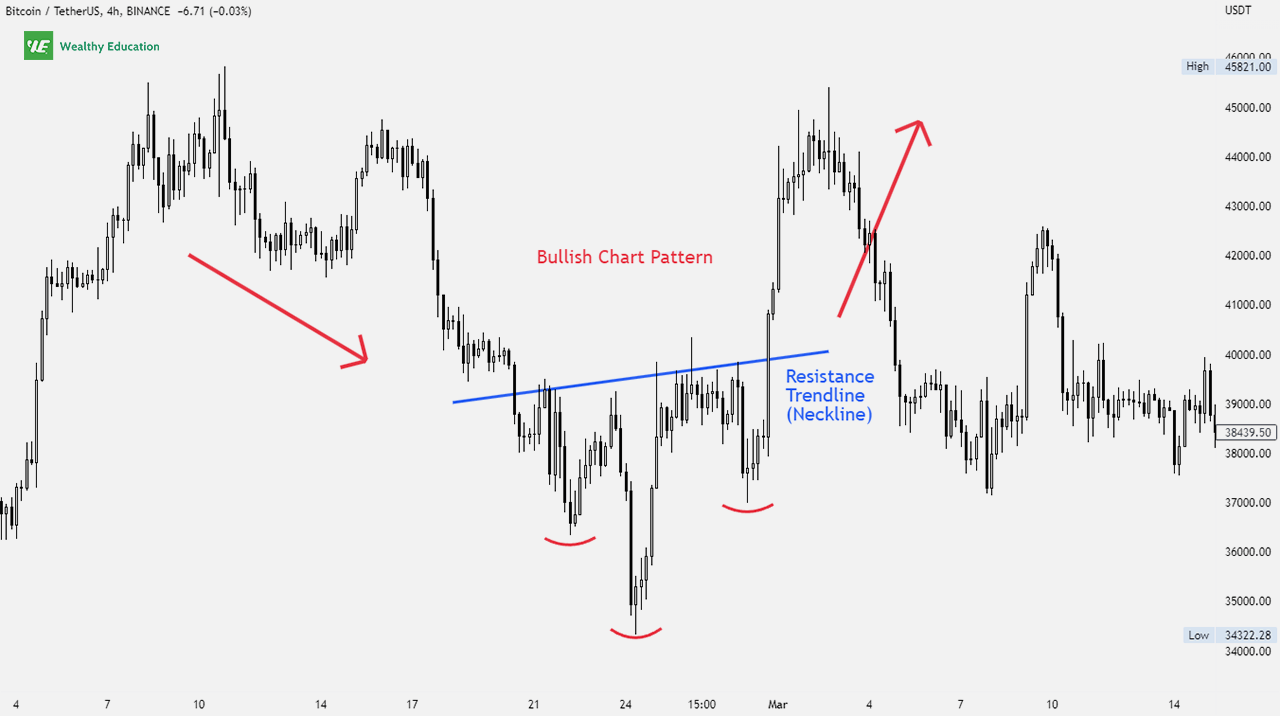

With the two troughs aligned, we hit a sturdy stand, indicating constant buying. There are dozens of popular bullish chart patterns. A trend line breakout is when the price closes beyond a trend line area of value, signaling a potential trend reversal in the markets;

An ascending trend line is called a bullish support line and a descending trend line is called a bearish resistance line. A bullish engulfing pattern is a candlestick pattern that forms when a small black candlestick is followed the next day by a large white candlestick, the body of which. These areas hold valuable market information and.