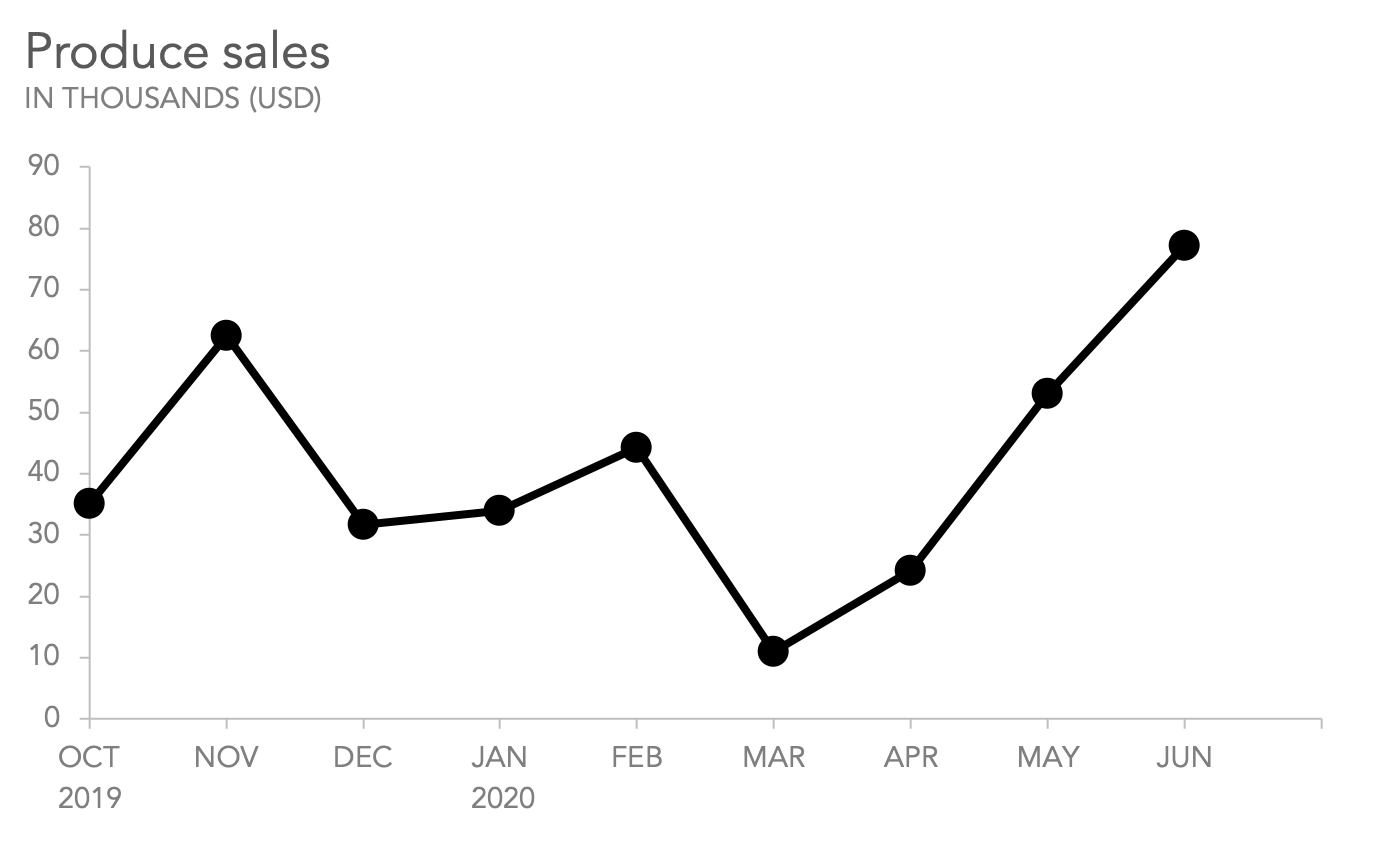

Stunning Info About How To Interpret Trend Lines Angular Time Series Chart

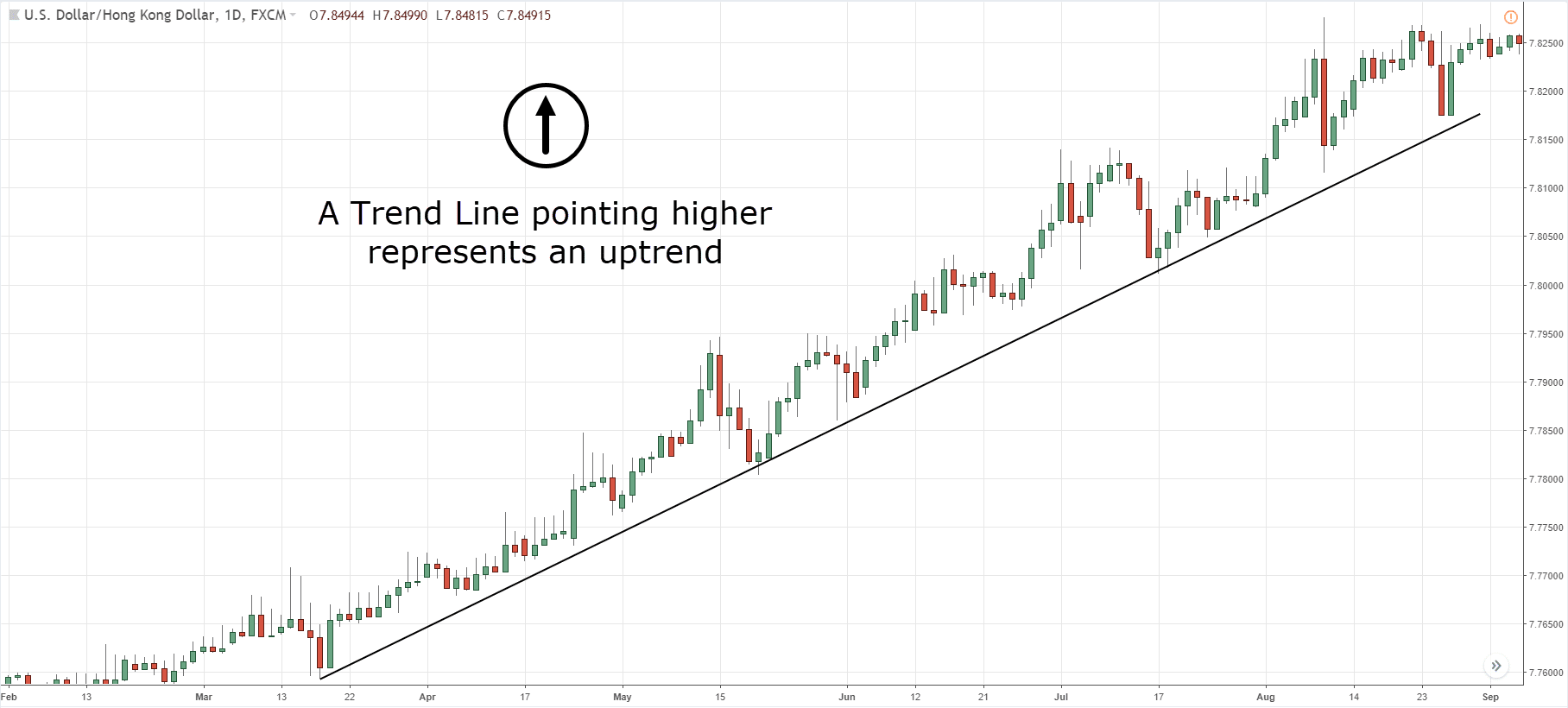

The resulting line is then used to give the trader a good idea of the direction in.

How to interpret trend lines. So, always buy near the support and sell near the resistance to have an edge in. Trend lines are distinctive lines that traders draw on charts to link a sequence of prices. The five different types of trend lines are:

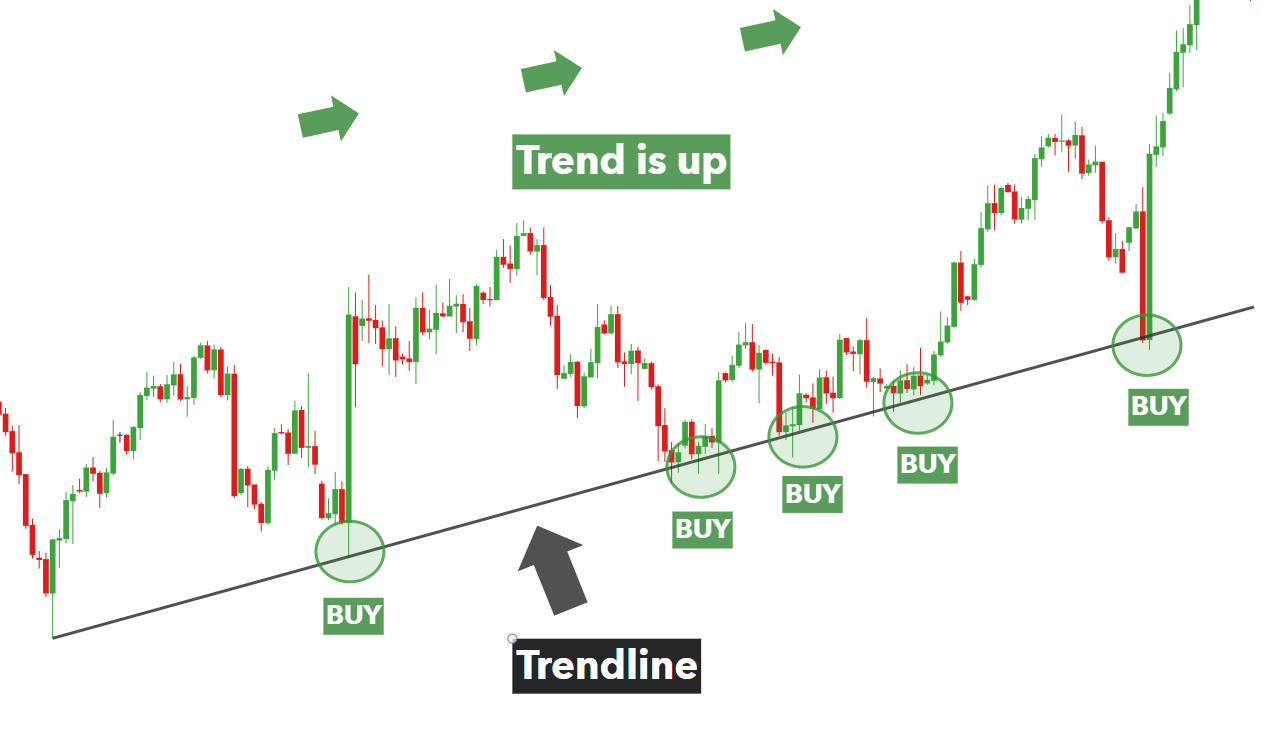

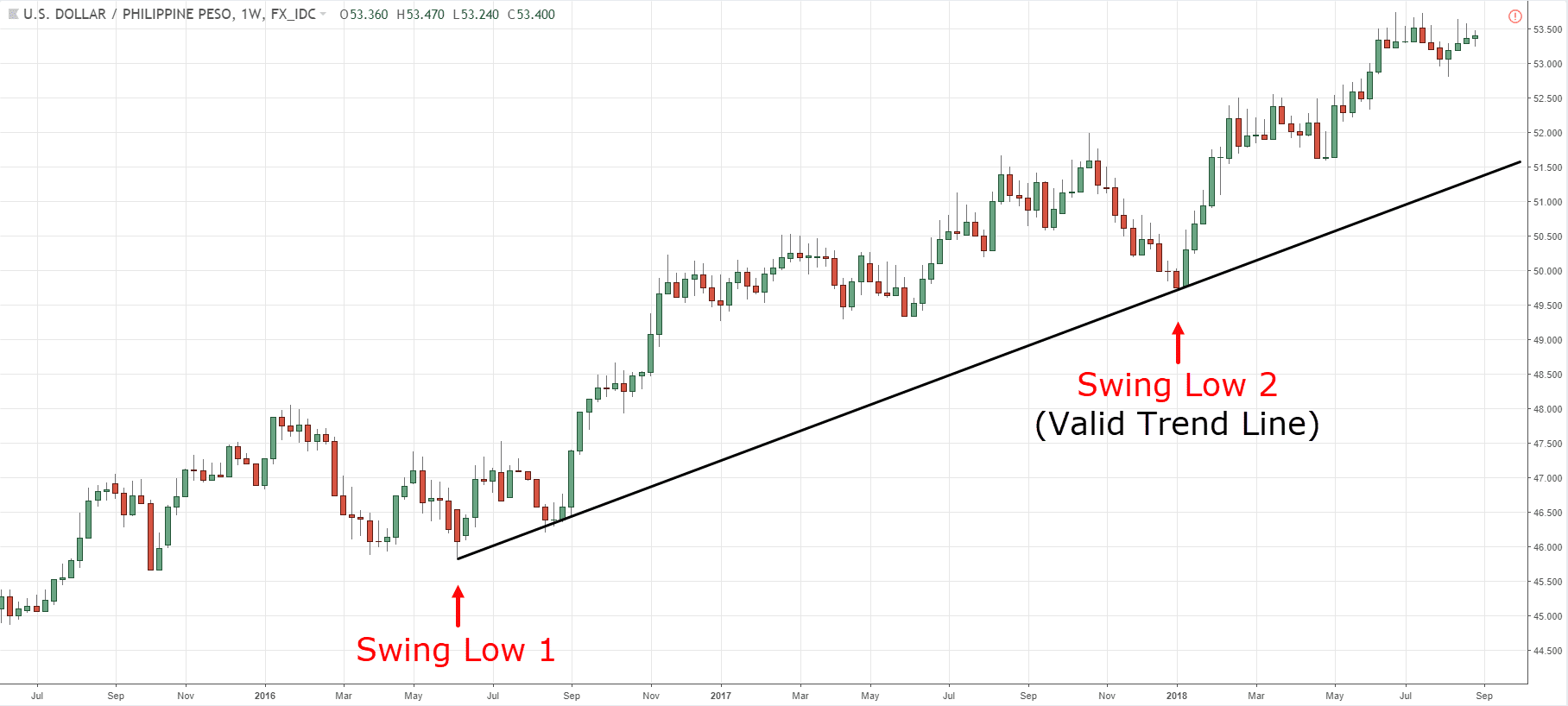

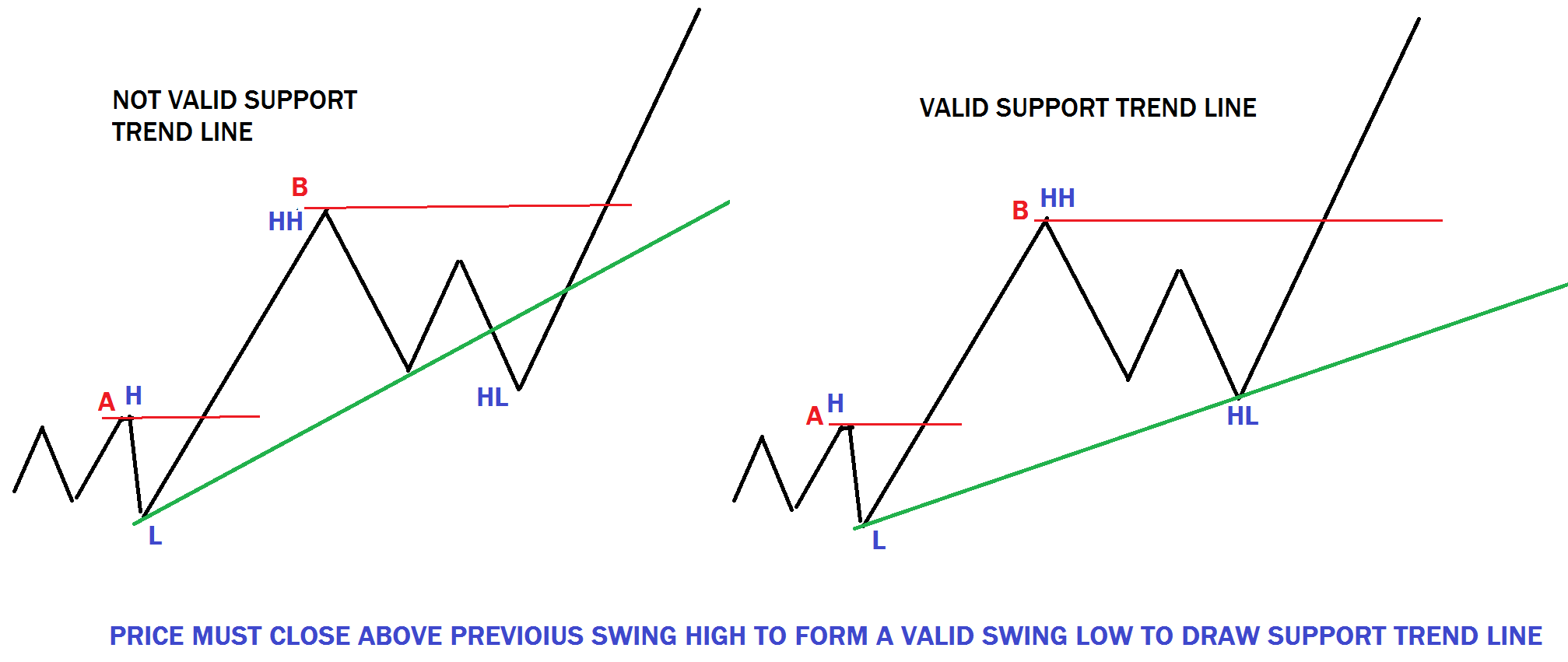

If you are a technical trader, chances are, the trendline is one of the first charting tools that you have learned to use. Trend line breakouts, trend line bounces, and trend line retests. Use swing slows to plot trend lines in an uptrend and use swing highs in an uptrend.

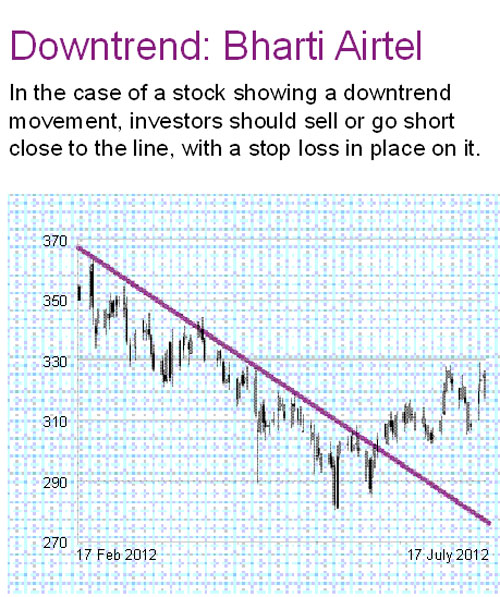

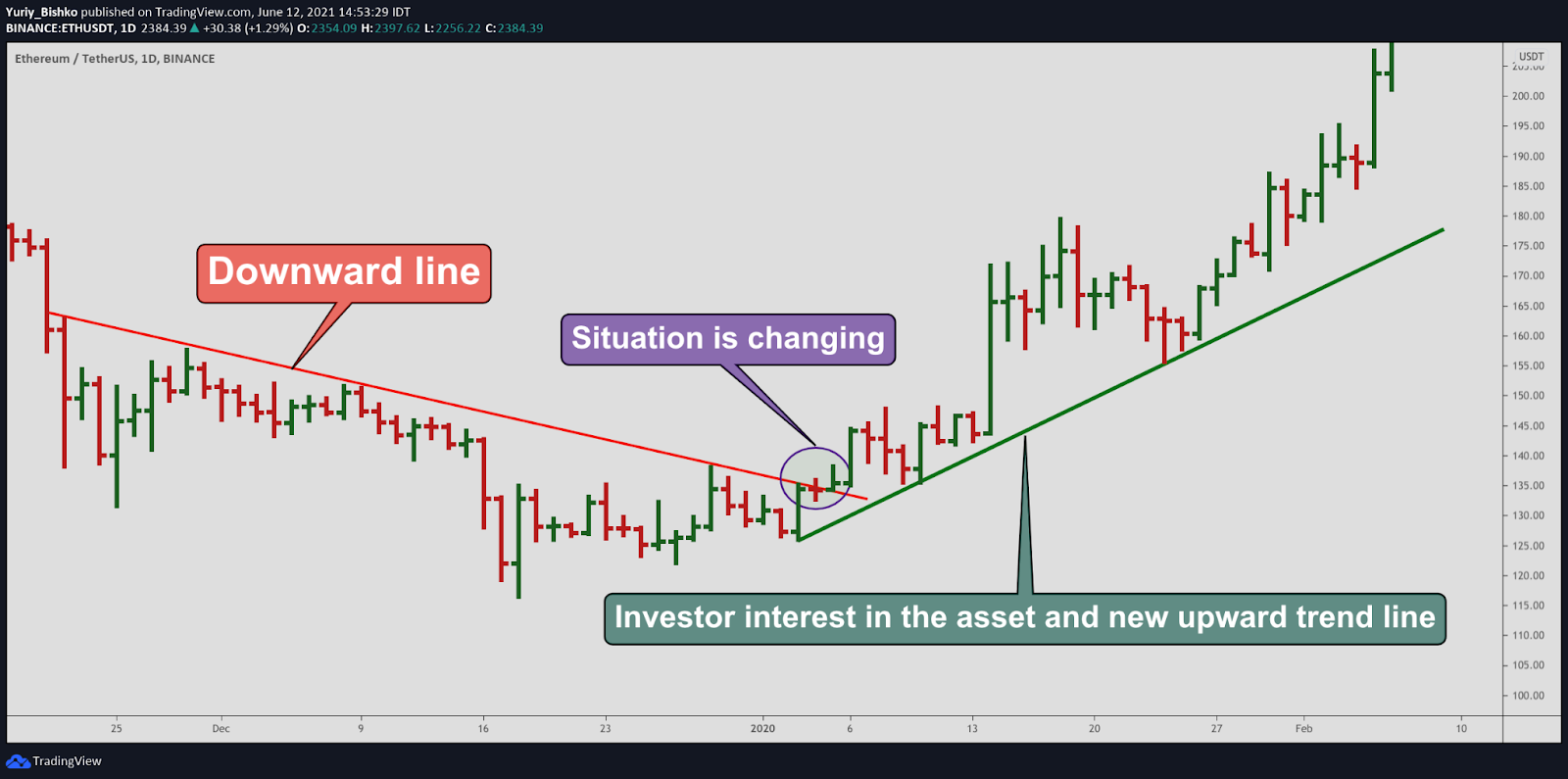

Trend lines are straight lines that connect two or more price points on a chart to identify and confirm trends. In a downtrend, a trendline connecting two swing highs and act as resistance, also called supply line. The lines between work and time off are blurring with the latest workplace and tiktok trend — quiet vacationing..

The trader can then utilize the resulting line to get a solid indication of the potential direction of an investment’s value movement. Its elegance comes from its simplicity: A proper trend line starts from when the actual move begins.

The trend line breakout strategy. Based on the highs and lows of a chart, trend lines indicate where the price briefly challenged the prevailing trend, tested it, and then turned back in its favor. Just trace the line and either follow the trend or wait for a breakout.

I'll also share with you 3 keys to success when using trend lines. This blog post was inspired by my cohort not really getting how trend lines are calculated when using tableau. But let’s say lloyd needs some math help and.

A positive trend line tells us the scatter plot has a positive correlation. Trend lines are used for prediction purposes (more on that later). A negative trend line tells us the scatter plot has a negative correlation.

It indicates an expandable section or menu, or sometimes previous / next navigation. The origination point of the trend line is not necessarily the high or low point of the price move. It is used to identify support and resistance levels and to help traders make buy or sell decisions.

How to ride massive trends using a simple trend line technique. A trend line is a straight line that connects two or more price points, indicating the direction of the overall trend. These lines follow a financial asset’s price movement to show traders how high or low the price may move in a particular duration.

By understanding how to interpret trend lines and spotting specific patterns, traders can gain valuable insights into potential entry and exit points in the market. A trend line connects at least 2 price points on a chart and is usually extended forward to identify sloped areas of support and resistance. How to use trend lines.

:max_bytes(150000):strip_icc()/dotdash_final_The_Utility_Of_Trendlines_Dec_2020-03-76899d38998e4ae196e8c9c3a6d2d55a.jpg)

![[ASMR] How to Draw and Interpret Trend Lines Stock Trading YouTube](https://i.ytimg.com/vi/XcXddrVKyiE/maxresdefault.jpg)